Your credit utilization ratio is a crucial factor that plays a significant role in your overall credit health. Whether you are looking to buy a home, finance a car, or simply maintain a strong credit score, understanding how your credit utilization ratio works is essential.

In this article, we will guide you through the concept of credit utilization ratio, how to calculate it, and how it can impact your credit score. We will also provide you with valuable insights into what constitutes a good credit utilization ratio and actionable tips for lowering it.

Whether you are just starting to build your credit or looking to improve your existing credit profile, this article will equip you with the tools and knowledge you need to manage your credit utilization ratio effectively and achieve your financial goals.

What is a credit utilization ratio?

A credit utilization ratio, also known as credit utilization rate, is a crucial financial metric that represents the percentage of your available credit that you are currently using.

Your credit utilization ratio reflects the amount of your available credit that you have used. This ratio is a significant element that credit bureaus use to determine your credit score and financial stability.

To better understand the concept, let's consider an example. Suppose you have two credit cards:

- Credit Card A has a credit limit of $5,000, and you have a current balance of $2,000.

- Credit Card B has a credit limit of $10,000, and you have a current balance of $4,000.

In this scenario, your credit utilization ratio for Credit Card A would be 40% ($2,000 / $5,000), and for Credit Card B, it would be 40% as well ($4,000 / $10,000).

How to calculate your credit utilization ratio?

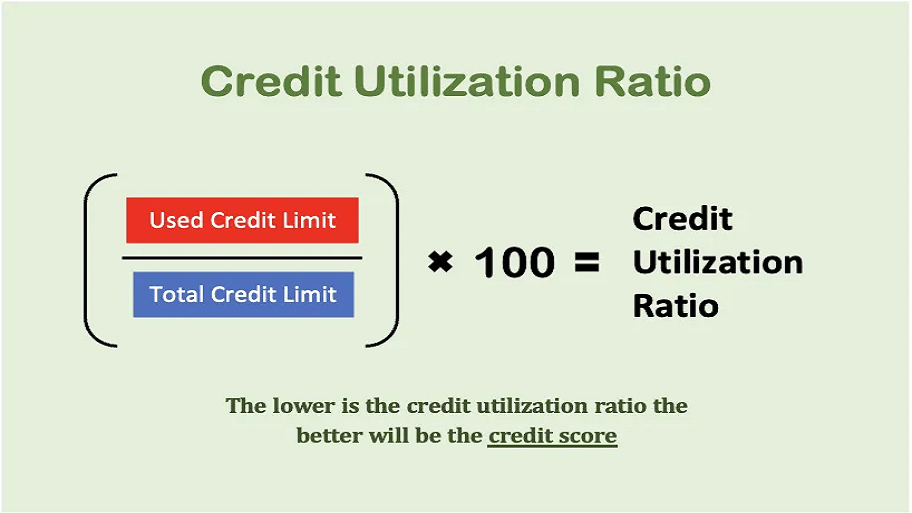

Calculating your credit utilization ratio is a straightforward process that involves dividing your total credit card balances by your total credit limits. Here's a step-by-step guide on how to do this:

- Determine the credit limit and the current balance for each of your credit cards.

- Add up the total credit card balances.

- Add up the total credit limits.

- Divide the total credit card balances by the total credit limits.

- Multiply the result by 100 to express the ratio as a percentage.

Let's use the example from Part 1 and calculate the overall credit utilization ratio:

1. We have the following information:

- Credit Card A: credit limit of $5,000 and a current balance of $2,000

- Credit Card B: credit limit of $10,000 and a current balance of $4,000

2. Total credit card balances: $2,000 (Card A) + $4,000 (Card B) = $6,000

3. Total credit limits: $5,000 (Card A) + $10,000 (Card B) = $15,000

4. Divide the total credit card balances by the total credit limits: $6,000 / $15,000 = 0.4

5. Multiply the result by 100 to get the percentage: 0.4 x 100 = 40%

In this example, the overall credit utilization ratio is 40%.

How your credit utilization ratio affects your credit scores

Your credit utilization ratio is a key factor in determining your credit score, comprising around 30% of your FICO score. It is considered the second most important factor after payment history, as it helps credit bureaus to determine your level of credit risk and evaluate your ability to manage finances.

A high credit utilization ratio indicates that you are using a large portion of your available credit, which can signal to lenders that you may be struggling to manage your debt or are at a higher risk of defaulting on future payments. This perception can lead to lower credit scores and potentially affect your ability to secure loans or get favorable interest rates.

A low credit utilization ratio indicates that you are not heavily reliant on credit and can manage your finances responsibly. This can increase your creditworthiness and make lenders more willing to offer you loans with better terms and rates.

For example, consider two individuals with the same credit limit of $10,000:

- Person A has a credit card balance of $2,000, resulting in a credit utilization ratio of 20%.

- Person B has a credit card balance of $8,000, resulting in a credit utilization ratio of 80%.

In this scenario, Person A would likely have a higher credit score than Person B, given that a lower credit utilization ratio is generally seen as more favorable by credit bureaus.

What is a good credit utilization ratio?

A good credit utilization ratio is generally considered to be below 30%. Keeping your credit utilization at this level or lower signals to lenders and credit bureaus that you are using credit responsibly and not overextending yourself financially.

It's essential to keep in mind that you don't need to strive for a 0% credit utilization ratio. Having some credit utilization can actually positively impact your credit score since it indicates responsible credit management and active credit use.

Keep in mind that different lenders and credit bureaus may have slightly varying views on what constitutes a good credit utilization ratio. However, the 30% threshold is widely accepted as a general guideline for maintaining a healthy credit profile.

How to lower your credit utilization ratio

Lowering your credit utilization ratio can help improve your credit score and increase your chances of getting approved for loans or receiving better interest rates. Here are some strategies you can use to lower your credit utilization ratio:

Make credit card payments more than once a month

Paying your credit card bill multiple times within a month can help lower your credit card balance and decrease your credit utilization ratio. Additionally, maintaining a low balance compared to your credit limit is viewed positively by credit bureaus, as it contributes to a healthier credit profile.

Increasing your credit limit

Requesting a higher credit limit on your existing credit cards can help lower your credit utilization ratio, as it increases your overall available credit. However, be cautious when doing this, as it could lead to overspending if you don't manage your finances responsibly.

Spread your charges across multiple cards each month

Distributing your expenses across several credit cards can help keep the credit utilization ratio lower for each card. This method can be particularly effective if you have multiple cards with low balances and high credit limits.

Keep your credit card accounts open

Closing a credit card decreases your available credit, potentially raising your credit utilization rate and harming your credit score.

For instance, if you have two credit cards with a $10,000 combined credit limit and a $3,000 balance, your utilization rate is 30%. But if you close a card with a $5,000 limit, your rate could skyrocket to 60%.

Open a balance transfer credit card

Transferring your existing credit card balances to a new card with a 0% introductory interest rate can help you pay down your debt faster and potentially lower your credit utilization ratio.

For example, if you transfer a $4,000 balance from a card with a $10,000 limit to a new card with a $5,000 limit, your overall credit utilization ratio would drop from 40% to 26.67%.

Apply for a new credit card

Applying for a new credit card can increase your total available credit and help lower your credit utilization ratio. However, be mindful that applying for multiple credit cards in a short period can lead to several hard inquiries on your credit report, which could temporarily lower your credit score.

FAQs

Per-card vs. overall utilization — which is more important?

To maintain a healthy credit score, it's crucial to pay attention to both your overall credit utilization ratio and per-card utilization ratio. While the former provides a broad picture of your credit usage, the latter indicates how well you handle each credit account.

Maintaining a credit utilization ratio below 30% for both individual credit accounts and overall credit usage is a smart approach to keeping a healthy credit profile.

Is it good to have no credit utilization?

While it might seem like having no credit utilization would be ideal, it's actually better to have some level of credit utilization to demonstrate responsible credit use. A credit utilization rate of 0% could indicate that you are not actively using your credit or managing it effectively.

Aim for a credit utilization ratio below 30% to show that you can use credit responsibly without overextending yourself financially.

Summary

This article delves deep into credit utilization ratios, which play a crucial role in credit scoring. By analyzing the elements that affect credit utilization and their influence on credit scores, the article provides a thorough comprehension of this financial term.

Readers will gain insights into the importance of maintaining an optimal credit utilization ratio, as well as practical strategies for managing their credit usage to improve their financial standing.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.