How to Borrow Against Life Insurance [2023 Ultimate Guide]

Learn the ins and outs of borrowing against your life insurance and find out if it's the right option for you.

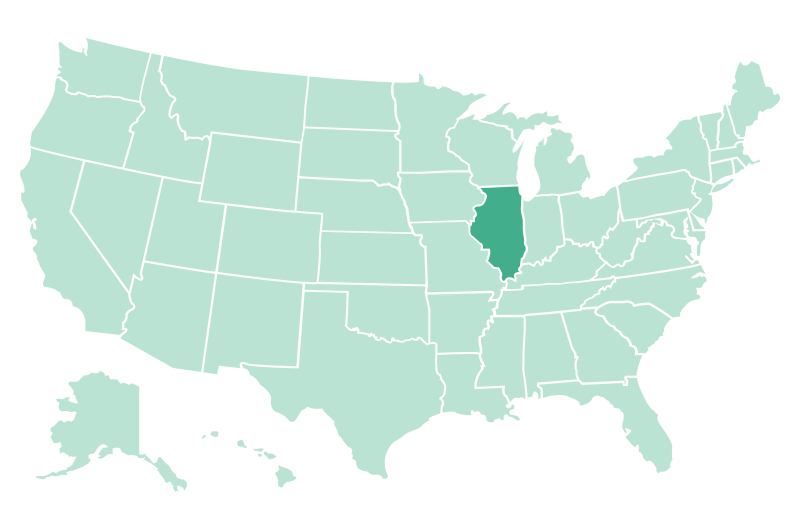

In Illinois, a uniform income tax rate of 4.95% is applied to all residents, ensuring that everyone's earnings are taxed at an equal percentage by the state. Furthermore, there are no additional local income taxes imposed by any cities within Illinois, on top of the state income tax.

Please note, this is more than the standard work hours in this time period. Dismiss

You can't withhold more than your earnings. Please adjust your income or additional withholdings.

You can't withhold more than your earnings. Please adjust your income or additional withholdings.

You can't withhold more than your earnings. Please adjust your income or additional withholdings.

You can't withhold more than your earnings. Please adjust your income or deductions.

You can't withhold more than your earnings. Please adjust your income or deductions.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

Good for: First-time home buyers and other borrowers looking for a broad array of loan choices.

This free paycheck calculator makes it easy for you to calculate an estimated take-home income amount for your paycheck. We also build in the latest federal and state tax rates on the calculator to improve the accuracy. Please follow the short guidance to calculate your take home paycheck amount:

Illinois enforces a flat state income tax rate of 4.95% for both individuals and corporations, in effect since July 1, 2017. For the tax year 2022, the personal exemption amount is set at $2,425. Taxpayers are required to pay the 4.95% tax on income exceeding this exemption amount.

| TAX TYPES | CURRENT TAX RATES | PRIOR YEAR RATES |

|---|---|---|

| Business Income Tax | Effective July 1, 2017:

|

BIT prior year rates |

| Individual Income Tax | Effective July 1, 2017:

|

IIT prior year rates |

| Personal Property Replacement Tax | Corporations – (other than S corporations)

Partnerships, trusts, and S corporations

|

|

| Withholding (payroll) | Effective July 1, 2017, 4.95 percent of net income is required to be withheld from:

if the winnings are subject to federal income tax withholding requirements. |

IRS income tax is mandatory and it makes adjustments for the tax brackets each tax year. Here is the quote from IRS for Tax Year 2022:

“Marginal Rates: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

The other rates are:

35%, for incomes over $215,950 ($431,900 for married couples filing jointly);

32% for incomes over $170,050 ($340,100 for married couples filing jointly);

24% for incomes over $89,075 ($178,150 for married couples filing jointly);

22% for incomes over $41,775 ($83,550 for married couples filing jointly);

12% for incomes over $10,275 ($20,550 for married couples filing jointly).

The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less ($20,550 for married couples filing jointly).”

Federal marginal tax rates refer to the rates at which income is taxed within the federal income tax system in a progressive manner. In the United States, the federal income tax system is designed with multiple tax brackets, each of which corresponds to a specific range of income levels. As your income increases, so do the tax rates you pay, but only for the income within that specific bracket.

Here's a simplified example to illustrate the concept. Suppose we have three tax brackets:

1. 10% tax rate for income up to $10,000

2. 20% tax rate for income between $10,001 and $50,000

3. 30% tax rate for income above $50,000

Now, if you earn $60,000 in a year, you won't be taxed at a flat 30% on your entire income. Instead, your income will be taxed at the marginal rates for each bracket:

So, your total tax liability would be $1,000 + $8,000 + $3,000 = $12,000.

Marginal tax rates ensure that higher-income individuals pay a larger percentage of their income in taxes, but only for the portion of their income that falls within the higher tax brackets.

FICA is a two-part tax. Both employees and employers pay 1.45% for Medicare and 6.2% for Social Security. The latter has a wage base limit of $160,200, which means that after employees earn that much, the tax is no longer deducted from their earnings for the rest of the year. Those with high income may also be subject to Additional Medicare tax, which is 0.9%, paid for only by the employee, not the employer.

If you reside in a state or city that imposes income taxes, these taxes will influence your net income. Similar to federal income taxes, your employer will retain a portion of each paycheck to account for state and local taxes. Consequently, understanding the tax rates and regulations for your specific location can help you better anticipate the impact on your overall take-home pay.

Local income tax is a tax levied by local government entities, such as cities or counties, on an individual's earned income. This tax is separate from federal and state income taxes and serves as a source of revenue for local governments to fund public services, infrastructure, and other community needs. The rate of local income tax varies depending on the jurisdiction, with some areas having higher rates than others. Taxpayers are typically required to file a local income tax return in addition to federal and state returns, though specific filing procedures and exemptions may differ by locality.

Getting the most out of your paycheck involves managing your finances wisely and taking advantage of available tax breaks, deductions, and benefits. Here are some tips to help you maximise your earnings:

Make sure the appropriate amount of taxes is being withheld from your paycheck. Adjust your withholding allowances on Form W-4 with your employer if necessary.

If your employer offers a 401(k) or similar retirement plan, consider contributing to it, especially if your employer matches your contributions. This not only reduces your taxable income but also helps you save for the future.

These accounts allow you to set aside pre-tax dollars for qualified medical and dependent care expenses. By using these accounts, you can lower your taxable income and save money on healthcare costs.

Make sure you're using all the benefits provided by your employer, such as health insurance, life insurance, and commuter benefits. These can save you money and improve your overall financial situation.

Familiarise yourself with tax deductions and credits that may apply to your situation, such as student loan interest deductions, the child tax credit, or the earned income tax credit. These can reduce your tax liability and increase your take-home pay.

This is one of the surest ways to make sure you're setting up the right allowances, deductions and withholdings.

Did you check your credit score recently and were left to wonder why did my credit score go down when nothing changed? You’ll find your answers here.

Taking a personal loan? Learn everything about personal loans, from how it works to where to find the best personal loans to fund your expenses here.

Want to unlock financial freedom with a good credit score of 750? Improve your credit today with our ultimate guide. Learn tips to achieve and maintain this score.