If you've ever been puzzled by the question, "Do credit cards have routing numbers?" Spoiler alert: credit cards don't have routing numbers! But don't stop reading here; we have much more to share with you.

We'll dive deeper into the differences between credit card account numbers and routing numbers and why they don't intersect. Plus, we'll explore the various situations where you'll need one or the other, ensuring you're well-equipped to navigate your financial transactions with ease.

Do Credit Cards Have Routing Numbers?

The simple answer to the question "Do credit cards have routing numbers?" is No. Credit cards do not possess routing numbers. Credit card transactions rely on a unique 16-digit account number assigned to each individual cardholder's account, which is used for authorizing payments and tracking transactions.

A routing number, on the other hand, is a unique 9-digit code used by financial institutions to facilitate the transfer of funds. It is important while conducting different financial activities, such as setting up direct payments or wire transfers.

This number serves as an electronic address that financial institutions in the United States of America use to identify each other. Routing numbers are assigned by the American Bankers Association (ABA) to credit unions, banks, and other financial institutions.

They are associated with bank accounts like checking and savings accounts and not individual credit cards. You can find these routing numbers on checks and bank statements but never on a credit card.

Why Credit Cards Don't Need Routing Numbers?

Credit cards don't require routing numbers because their primary function differs from that of bank accounts.

Routing numbers are used to identify a specific financial institution and its branch, allowing for smooth and accurate processing of transactions like direct deposits, wire transfers, and electronic bill payments. Bank accounts, such as checking and savings accounts, rely on routing numbers to facilitate these types of transactions.

These routing numbers are associated with financial institutions, but credit cards are owned by individuals. Cardholders use their credit cards for a number of purchases, both online and offline. They can also use them for balance transfers and cash advances.

Transactions that involve credit cards do not require a routing number because they don't require the identification of a particular bank branch.

When you use your credit card to make a purchase, the transaction is processed through a payment network.

A payment network is a type of financial system that enables electronic money transfers between various financial institutions, businesses, and customers. Payment networks serve as go-betweens, processing and confirming payments to speed up transactions and ensure that money is delivered securely and effectively.

These payment networks include Visa, Mastercard, Discover, and American Express. They utilize security features on credit cards like CVV codes, card expiration dates, and your unique 16-digit account number to authorize and manage transactions.

What Exactly is a Routing Number?

A routing number, also known as an ABA (American Bankers Association) routing number, is a nine-digit code that identifies a specific financial institution and its branch within the United States.

This number is used by banks, credit unions, and other financial institutions to facilitate a wide range of transactions, such as wire transfers, direct deposits, and electronic bill payments.

At a time when computers didn’t exist, the banking system relied heavily on manual processing and bookkeeping. They needed a method that could help them correctly identify that funds were withdrawn from and deposited to the correct banks.

A method of identification was required, and in 1910 the routine number was introduced by the American Bankers Association (ABA). It was created to automate the grouping, delivery, and distribution of paper checks to the relevant bank locations.

The routing number helps guarantee that the money is routed to the relevant financial institution and account. Thus, routing numbers are still a crucial element of the financial system and continue to perform their original purpose to date.

Each routing number consists of three main components:

- The first four digits represent the Federal Reserve Routing Symbol, which indicates the Federal Reserve District and the Federal Reserve Bank or branch that serves the financial institution.

- The next four digits identify the specific financial institution or bank.

- The last digit is a check digit, which is calculated using an algorithm and serves as a verification tool to help detect errors in the routing number.

What Type of Accounts Have Routing Numbers?

Routing numbers are associated with a variety of bank accounts and financial institutions. The types of accounts that typically have routing numbers include:

1. Checking accounts: A checking account is a sort of bank account that allows you to deposit and withdraw money on a regular basis. It is commonly used for day-to-day financial transactions, such as paying bills, making purchases, and receiving payments.

2. Savings accounts: Savings accounts are designed to help you save money over time. Unlike checking accounts, they don't have a high volume of daily transactions being performed. However, they still have routing numbers.

The routing number is used for activities such as setting up direct deposits, moving funds between accounts, and making wire transfers.

3. Business accounts: Business accounts allow firms to manage their money, collect payments from consumers, and make payments to vendors and suppliers. A business account can be both a checking and savings account.

These accounts may have several users, such as workers or accountants, who need access to the account. The routing number allows each user to begin transactions and guarantees that the money is sent to the relevant financial institution.

4. Money market accounts: A money market account is a form of savings account often offering greater interest rates than ordinary savings accounts. They have routing numbers to assist transactions, including direct deposits and electronic transfers.

These accounts can also be connected to checking accounts for overdraft protection. In this situation, the routing number is utilized to send cash from the money market account to the checking account to pay any overdrafts.

5. Investment and brokerage accounts: Investment accounts are used for investing in financial instruments like stocks and bonds to increase money over time.

Brokerage accounts are created with corporations to purchase and sell shares and other investment items. Certain investment and brokerage accounts may also have routing numbers, particularly if they are tied to a bank and provide checking-like services.

It's important to note that routing numbers are specific to each financial institution and may vary depending on the type of account and the bank's location. Additionally, some banks may have multiple routing numbers based on their geographic reach and the services they provide.

Where Can I Find My Routing Number?

Here are some common ways to find your routing number, along with detailed explanations and examples:

You Find it On a Check

One of the easiest ways to find your routing number is to look at a personal or business check associated with your account.

The routing number is located at the bottom left corner of the check, printed in magnetic ink. It's the first set of nine digits, followed by your account number and the check number. For example, if the numbers printed at the bottom of your check read "123456789 9876543210 1234," the routing number would be "123456789."

You Can Find it On a Bank Statement

Banks use a routing number as a code to determine where your account is located. This number can typically be found on your bank statements, which serve as records of account activity. These statements can be viewed digitally on your bank's website or printed out and mailed to you.

On a paper statement, search for your routing number next to your account number. If you have an online banking account, you can log in and check your electronic statement to find the routing number. The information will appear next to your account number.

Try Using Online Banking Platforms

Many banks and credit unions provide their routing numbers on their websites or within their online banking platforms. Once you log in to your account, you can usually find your routing number under "Account Information," "Account Details," or a similar section. Some banks also have a dedicated page or FAQ section that lists their routing numbers.

Call the Bank

If you're unable to find your routing number using the methods above, you can call your bank's customer service for assistance. Most financial institutions have toll-free numbers or dedicated helplines for this purpose. Be prepared to provide personal information to verify your identity before the bank representative shares your routing number.

Visit a Local Branch Near You

If you’ve tried the other methods and still can’t obtain your routing number, you can visit a local bank near you. You can speak to a bank representative who can provide you with the necessary information.

Before a bank representative attends to you, they might need you to show them a form of identification and answer personal questions. Ensure you take along your ID card or any other document that can prove your identity as the owner of the account.

The American Bankers Association's Routing Number Lookup Tool

The American Bankers Association (ABA) routing number lookup tool has a wide database of almost 18,000 unique numbers. The lookup tool allows individuals to identify participating financial institutions' routing numbers.

The website allows no more than two look-ups a day and a maximum of 10 per month. People might need to find the routing number for their financial institution for a number of reasons. These are a few typical examples:

- Direct deposits

- Automated Clearing House (ACH)

- Wire transfers

- Bill payments

- Tax refunds

In What Situations Will You Need Your Routing Number?

Here are some common situations when you'll need your routing number:

1. Setting up direct deposits: When you set up a direct deposit for your paycheck, tax refund, or government benefits, you'll need to provide your routing number and account number to route the funds to your account.

2. Transferring money between banks: When you transfer money between accounts at different banks or credit unions, you'll need the routing numbers for both the sending and receiving financial institutions.

3. Wire transfers: Routing numbers are necessary for domestic wire transfers to ensure the funds are sent to the correct bank and branch.

4. Electronic bill payments: Because many businesses allow consumers to pay their bills electronically utilizing ACH transfers, you might need your routing information to make your payments.

An electronic transfer, known as an ACH transfer, is used to transfer funds between American bank accounts. You must include both your account number and your bank's routing number when setting up an ACH transfer to pay your invoices.

5. Setting up automatic payments: Recurring payments for loans, bills, and other utilities still rely on the ACH system to transmit money between accounts.

When you set up automatic payments, you normally supply the firm with your account number and your bank's routing information. The corporation will then use this information to conduct ACH transfers from your account to pay your invoices.

6. Paying taxes: To make electronic payments for taxes, you might need to supply your bank's routing number to the Internal Revenue Service (IRS). This allows the IRS to transmit the money safely and efficiently from your account to theirs.

7. Receiving tax refunds: If you choose to receive your tax refund via direct deposit, you'll need to provide your routing number and account number on your tax return.

8. Ordering checks: When you order personal or business checks, you'll need to provide your routing number and account number to print the correct information on your checks.

9. ACH transactions: Routing numbers are used for Automated Clearing House (ACH) transactions, which include direct deposits, electronic bill payments, and other types of transfers.

What Is an Account Number on a Credit Card?

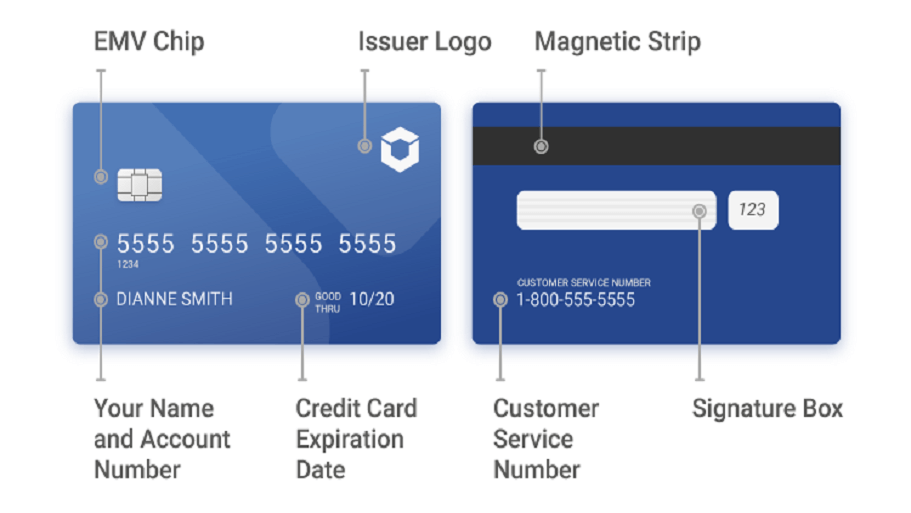

The credit card account number refers to the raised letters on the front surface of your credit card. This unique identifier is usually 16 digits long. It serves to identify your card and authorize transactions you make with it.

This unique card account number is also recorded in the magnetic stripe or integrated into the chip of the credit card.

When you make a transaction with your credit card, the merchant will swipe it or place it into a chip reader, which reads the encoded information on the magnetic stripe or chip and authorizes your transactions.

Different credit card providers have their own numerical systems. However, there are certain basic similarities that have been observed.

For example, the first digit of the account number represents the Major Industry Identifier (MII), which signifies the card's industry category. Here are some common MIIs:

- 3: Travel and entertainment (e.g., American Express and Diners Club)

- 4: Visa

- 5: Mastercard

- 6: Discover

The next few digits represent the Issuer Identification Number (IIN), also known as the Bank Identification Number (BIN), which identifies the card's issuing institution. The remaining digits are unique to each cardholder and their specific account.

Apart from the account number, credit cards also have additional security features like the Card Verification Value (CVV) code and the expiration date, which help prevent unauthorized transactions.

Let's take a look at a hypothetical credit card number: 4123 4567 8901 2345

- The first digit (4) indicates that the card is a Visa.

- The following digits (123) identify the issuing institution.

- The remaining digits (4567 8901 2345) are unique to the cardholder's account.

To summarize it all, credit card account numbers are usually 16-digit long identifiers. They are embossed on the surface of the credit card and encoded into the card’s chips. Each credit card issuer has a specific numbering system with the account number signifying a mix of industry, issuing institution, and individual account information.

Credit Card Number vs. Routing Number

Purpose

Routing numbers' primary purpose is to show which financial institution a specific bank account is linked to. The routing number is also used to identify banks and other financial institutions in the United States.

By guaranteeing that money is accurately transmitted between accounts and institutions, they facilitate various banking activities. These include wire transfers, direct deposits, and electronic bill payments.

Credit card numbers, on the other hand, individually identify a person's credit card account. This number is used by financial institutions and retailers to process transactions and authorize payments for purchases made with individual credit cards. Some of these transactions include purchases, cash advances, and balance transfers.

Structure

Routing numbers are nine-digit codes, with the first four digits representing the Federal Reserve Routing Symbol, the next four identifying the specific financial institution, and the last digit serving as a check digit for error detection.

Credit card numbers are typically 16 digits long, with the first digit representing the Major Industry Identifier (MII), the next few digits signifying the Issuer Identification Number (IIN), and the remaining digits being unique to the cardholder's account.

Usage

Routing numbers: Also known as Routing Transit Numbers (RTNs). They serve as electronic addresses used to identify financial institutions. They play a vital role in daily banking transactions.

These transactions include transferring money between banks, setting up direct deposits, and processing electronic bill payments. Routing numbers are also associated with individual bank accounts like checking and savings accounts.

Credit card numbers: Credit card numbers can be used for credit card transactions. These transactions include but are not limited to cash advances, online purchases, and balance transfers.

They are not associated with routing numbers because they do not require the names of receiving banks to complete the transaction. Instead, payment networks like Visa, Mastercard, American Express, or Discover handle credit card transactions.

What Occasions Require Your Credit or Debit Card Numbers?

Credit cards allow you to borrow money from the card issuer up to a certain limit to make purchases, debit cards enable you to spend the money available in your linked bank account. Here are some common uses for credit card and debit card numbers:

1. Bill Payment: To pay bills, such as utilities, phone services, or loans, you'll need to provide your credit or debit card number to process the payment.

2. Automatic payments: Regular bills, such as subscriptions, gym dues, or insurance premiums, can be conveniently paid with automatic payments. Your credit card or debit card can be used to set this up.

This means that money will be automatically deducted from your account to cover these costs, saving you the trouble of having to remember to pay them each time. By doing this, you may maintain your payments on schedule and prevent late fees.

3. Online Shopping: When you shop online, you'll typically be required to provide your card number, expiration date, and security code (CVV) to authorize the transaction.

4. Transferring Money: While credit cards are generally not used for transferring money, debit cards can be linked to your bank account to send and receive funds via services like Zelle, PayPal, or Venmo. Your debit card number helps identify your account during these transactions.

5. Withdrawing Cash (debit cards only): Debit card numbers are used to withdraw cash from ATMs. When you insert your card into an ATM, the machine reads your card number and verifies your identity using your Personal Identification Number (PIN) before dispensing cash.

6. Making In-Store Purchases: Your card number, either encoded in the magnetic stripe or embedded in the chip, is read by the card reader at the point of sale to authorize the transaction.

7. Online Service and Digital Wallets: Tokenization is the method of replacing sensitive information like credit or debit card numbers with a unique token or code that is individual to the transaction.

This is the process we see when credit and debit cards are added to digital wallets like Apple Pay, Google Pay, or Samsung Pay.

Tokenization ensures contactless online payments to protect the user's card information. Your card details are tokenized by these services to increase transaction security.

8. Booking travel: When booking flights, hotels, or car rentals, you'll need your credit or debit card number to reserve and pay for the services.

9. Deposits and guarantees: Your credit card information might be requested when making reservations for a hotel room or car rental as a guarantee or for incidents.

These companies request this information to safeguard themselves in the event that you fail to pay for additional costs or damages incurred during your stay or rental period.

10. Renting or subscribing to digital services: When signing up for digital services like streaming platforms, cloud storage, or software subscriptions, you'll need your card number for billing purposes.

FAQs

Why Do Banks Have Routing Numbers?

Banks have routing numbers to identify specific financial institutions and their branches. Routing numbers are used to facilitate various banking transactions, such as wire transfers, direct deposits, and electronic bill payments, ensuring that funds are accurately transferred between accounts and institutions.

Do all financial institutions have a routing number?

A routing number is a specific identifier that assists in recognizing banks or credit unions in the United States. Not all financial organizations have these numbers because they are exclusively provided to specified institutions that meet certain conditions.

To receive a routing number, a financial institution must be formally recognized by the government and approved by the Federal Reserve Bank.

Only specific banks and credit unions have routing numbers. Other financial enterprises, such as investment firms or loan companies, do not.

But, sometimes, these firms that don't have their own routing numbers will partner with banks to provide services like sending money or setting up automatic deposits. In these cases, the routing number of the bank they're partnering with would be used for the transaction.

Do all debit cards have routing numbers?

Debit cards themselves do not have routing numbers. However, they are linked to checking or savings accounts, which do have associated routing numbers. When you need to provide a routing number for a transaction involving a debit card, you'll use the routing number of the bank account linked to the card.

Can a thief use a routing number to access my checking account?

Routing numbers are virtual addresses for banks and not individual accounts. If a thief has access to your routing number, they cannot directly access your checking account.

The only way anyone can gain access to your account and make unauthorized transactions is if they have your personal banking information in addition to your routing number.

To protect yourself from fraud and theft, keep all your sensitive banking information confidential.

What Is the Difference Between ABA and ACH Routing Numbers?

ABA (American Bankers Association) routing numbers and ACH (Automated Clearing House) routing numbers both identify financial institutions and their branches. The key difference lies in their usage:

- ABA routing numbers are used for various banking transactions, such as paper checks and wire transfers.

- ACH routing numbers are used for electronic transactions, like direct deposits and automatic bill payments.

Some financial institutions use the same routing number for both ABA and ACH transactions, while others have separate routing numbers for each purpose. Always verify which routing number to use for your specific transaction to avoid delays or errors.

Summary

Credit cards do not have routing numbers. Instead, credit cards have a 16-digit account number used for processing transactions.

Understanding the differences between routing numbers and credit card numbers, as well as their respective purposes, is essential for accurate and secure financial transactions. Furthermore, understanding the context in which these numbers are used can help prevent potential issues or delays in financial processes.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.