Are you seeking a quick solution for unforeseen expenses or pressing financial needs? Cash App, a popular financial platform with services like peer-to-peer payments and investing, could be the answer. But is it the best option for urgent cash requirements?

In this ultimate guide, you can find all the must-know knowledge about loans on cash apps, which entails the pros and cons, procedures, frequently asked questions, and different scenarios to help you make the best decision. Let's start now!

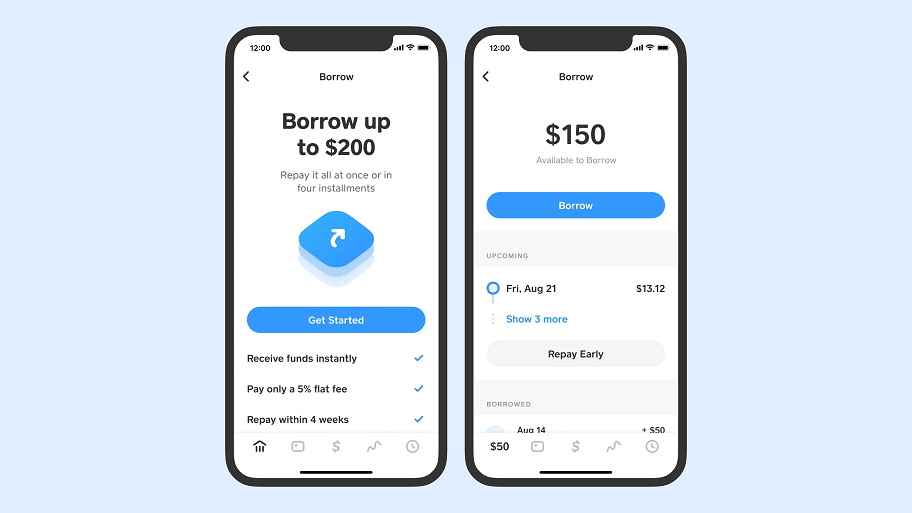

What Is Cash App Borrow?

A cash app is a payment app on your mobile devices that provides various transaction services, such as transferring money to others, paying bills via direct deposit, and investing in stocks and bitcoin. The app functions similarly to other peer-to-peer payment apps like PayPal and Venmo.

With cash app borrow, you can take out a short-term loan of up to $200, which must be repaid within four weeks. If you fail to repay the loan, you may incur a 1.25% late fee each week until the amount is repaid. The loan is for personal or household purposes, not postsecondary educational expenses.

Whether you qualify for the cash app borrow depends on several factors, including your deposit history, residency status, credit history, and user history.

The borrowing process is straightforward. After you apply and are approved for a loan, the funds are immediately deposited into your cash app balance. You can use the funds to make purchases or transfer the money to your bank account. When the loan is due, the principal amount plus any fees or interest is automatically deducted from your cash app balance.

How to Use Cash App Borrow

If you're eligible to use cash app borrow, you can easily apply for a loan from the app's dashboard. Here's a step-by-step guide on how to use cash app borrow:

- Open the Cash App on your mobile device.

- Tap the "Borrow" icon located at the bottom of the screen.

- Click the "Unlock" bottom to apply for a loan. Enter the amount you want to borrow (up to $200).

- Review the loan terms and fees.

- Tap "Continue" to apply for the loan.

- Wait for Cash App to review your application.

You are not eligible for this service if it's not shown in your menu.

Tips:

- Once your application is approved, the loan amount will be deposited into your cash app balance.

- When the loan is due, the principal amount plus any fees or interest will be automatically deducted from your cash app balance.

- Be mindful that if your current cash app balance can't cover the repayment deduction, the app will attempt to debit other bank accounts you have linked. If the bank account doesn't have enough funds to cover the loan, you may incur additional fees and interest.

How to Repay Money Borrowed From Cash App

Autopay

You can have your money automatically deducted by the app to make your payments through monthly incremental payments over the four-week loan term or a single, one-time payment. This method helps ensure you make your payments on time so you don't incur additional fees or interest.

Manual:

You can make manual payments through the app before the due date. This method allows you to choose the payment amount and timing, giving you more control over your repayment schedule.

By mail:

You can mail a check to the address shown on your statement. You may choose this option if you'd instead send money by mail or don't have access to the app. Additionally, make sure the company could receive your mail by 4 p.m. CT.

Tips:

- Repaying your loan on time can avoid incurring additional fees and interest. If you default on your Cash App Borrow loan, the outstanding balance may be deducted from your cash app balance or debit card.

You may continue to accrue interest until your balance is paid in full, while your cash app access can be blocked.

- Cash app does not charge a prepayment penalty. Therefore, you can repay the loan anytime without incurring additional fees.

- To check the status of your loan and repayment schedule, tap the "Borrow" icon on your cash app dashboard.

- You can contact app's customer service for assistance if you have any questions or concerns about repaying you loan.

General Eligibility for Cash App Borrow Is Based on the Following:

Cash app borrow is not available to all users. Eligibility criteria for cash app borrow are based on several factors, including:

Regular deposit history: Users who deposit money into their cash app account frequently are likelier to be eligible for the Borrow feature.

State of residence: Cash app borrow is unavailable in all states, and eligibility criteria may vary by state.

Activated Cash Card: An active Cash Card is a must for access to the Borrow feature.

User history: cash app considers how often you deposit money into your account and transfer money to other users.

Credit history: cash app may consider your credit history to determine your eligibility for the borrow feature.

Additional factors: In addition to credit history, other factors are considered to decide your eligibility for cash app borrow, such as how long you've been a cash app user and your transaction history.

Also, note that cash app borrow is only meant for personal or household purposes and can't be used to cover post-secondary educational fees. Cash App Borrow may only be available in some states, so check your eligibility before applying for a loan.

When to Use Cash App Borrow

Cash app borrow is a valuable tool for those who need access to small, short-term loans for emergency expenses. Since cash app borrow is intended for short-term smaller loans, the feature is ideal for minor costs that can be repaid within a month.

Cash app borrow can be helpful in several situations, including:

Emergency expenses

If you have an unexpected expense, such as a medical bill or a car repair, cash app borrow can help you bridge the gap until your next paycheck.

Household bills

If you're struggling to pay your bills and need a small loan to make it through the month, cash app borrow can provide a solution.

Low-cost expenses

If you need to pay for a small expense, such as a utility bill or a grocery purchase, it can be a convenient and quick option.

However, it's essential to carefully consider whether borrowing money through cash App is the right choice for you.

Here are some factors to consider when deciding whether to use cash app borrow:

Your financial situation: Before borrowing money, it's vital to assess your financial situation and determine whether you can repay the loan.

Ensure you maintain your financial capability when you borrow on the Cash App to cover emergency expenses.

Interest and fees: cash app borrow usually charges a 5% flat fee on the amount borrowed, which is due along with the loan, within four weeks. If you can't repay the loan on time, you'll incur additional interest and late fees, which can quickly add up.

Alternatives: Before borrowing money through cash app, consider any alternative options, such as credit cards or personal loans, that are available. These options may offer lower interest rates and more flexible repayment terms.

Borrowing on the cash app can be helpful in some scenarios, but it always comes at an extra price with restrictions, which must be repaid with interest and fees over the loan term. Before taking on a loan, remember to check if you have better financial solutions, such as borrowing from family and friends, which may reduce your cost and provide more flexibility in repayment terms and conditions.

Ultimately, whether to use cash app borrow is a personal decision that depends on your financial situation and needs. Don't forget to read and understand the terms and conditions of the loan before applying for money through cash apps.

The States Where Cash App Borrow Is Available: (So Far)

Alabama

California

Georgia

Idaho

Illinois

Indiana

Iowa

Kansas

Louisiana

Michigan

Mississippi

Missouri

North Carolina

Ohio

Tennessee

Texas

Utah

Virginia

Wisconsin

Does Cash App Borrow Assess Your Credit Score?

Uncovering the credit check process

When you sign up for a cash app, a credit check is conducted, even without a formal loan application. This check serves multiple purposes, such as identity verification, determining your borrowing eligibility, and other reasons. According to their terms of service:

Your credit record may be obtained by cash app through its associated entities for legal reasons, including identification verification, loan decision-making, loan servicing, marketing, and internal analytics. While initially providing personal information won't impact your credit score, a loan application or acceptance could affect it due to credit report inquiries.

Cash app may report account information to credit bureaus, and any late or missed payments could negatively impact your credit report. If you discover errors in the reported information on your credit report, you can notify the cash app of the inaccuracies with justification.

Tips for Cash App Borrow Eligibility and Credit Concerns

While cash app borrow will check your credit score, the company's eligibility requirements are generally less strict than traditional lenders.

In addition to credit history, other factors are considered to decide your eligibility for cash app Borrow, such as regular deposit history, residence status, user history, and if you have an active cash card.

Be mindful to review your credit report and check for possible errors, mainly if you are worried about your credit score or your eligibility for cash app borrow. Also, consider contacting the app's customer support for more information about eligibility requirements and the application process.

Other Cash App Features

1. Cash App Card - Personalized Debit Card

Cash App offers a debit card connected to your account balance, which can be used anywhere Visa is accepted. You can even personalize the design of the card to your liking.

2. Direct Deposit - Seamless Paycheck and Tax Return Receipt

With routing and account numbers, users can make direct deposits into their accounts for things like paychecks, tax returns, and more. Additionally, deposits on the Cash App are permitted up to $50,000 per day and $25,000 per transaction.

3. Cash Boost - Save Money at Participating Locations

Cash Boost is a cashback service to help you save money. It offers cash returns whenever you purchase with your Cash Card at participating locations, such as coffee shops, restaurants, retail stores, and other establishments.

4. Immediate Access - Instant Availability of Deposited Funds

When receiving a direct deposit, the funds become instantly available within your Cash App account.

5. ATM Access - Withdraw Cash with Monthly Direct Deposit

You can use your Cash Card at any ATM if you have at least $300 directly deposited into your account each month. But an additional fee of $2 will be charged for each ATM withdrawal.

Alternative for Cash App

Personal Loans from Banks, Credit Unions, Online Lenders, and Brokers

Traditional banks, credit unions, online lenders, and brokers offer personal loans with competitive interest rates and flexible repayment terms. These institutions may consider factors beyond your credit score when determining eligibility, providing various borrowing options for diverse financial needs.

Peer-to-Peer Lending Platforms

Online peer-to-peer lending platforms like LendingClub and Prosper connect borrowers with individual investors. Compared to traditional financial institutions, these platforms have fewer restrictions on eligibility and more flexibility in borrowing options.

Credit Card Cash Advances

Credit card cash advances are loans offered by card issuers, allowing cardholders to borrow money against their line of credit. It can be a convenient short-term borrowing alternative, but usually with higher interest rates and costs.

Payday Loans

Payday loans are small, short-term loans typically due on your next payday. They tend to have high-interest rates and fees, making them a less desirable option. But for borrowers with poor credit or no credit who face limited loan options, payday loans can be a good alternative.

Borrowing from Friends or Family

Sometimes, borrowing money from friends or family can be a suitable alternative. It may offer more flexibility and potentially lower interest rates or no interest. However, you should establish clear terms and expectations for your healthy relationships.

FAQs

1. Are Prepayment Penalties Applicable to Cash App Borrow?

No. cash app borrow does not impose prepayment penalties, allowing you to repay your loan ahead of schedule without incurring additional charges.

2. Reasons for Ineligibility to Borrow from Cash App

Cash app borrow may not be accessible to some states or users who don't fit specific criteria or have bad credit. Factors considered include deposit frequency, transaction history, credit history, and Cash Card possession.

3. Can Cash App Borrow Improve Your Credit Score?

Cash app borrow might help your credit, but it's more likely to hurt your credit score if you miss payments. These apps can submit your account information to credit bureaus, such as late or missed payments, but whether on-time payments would be reported needs to be specified in the Loan Agreement.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.