Mortgages

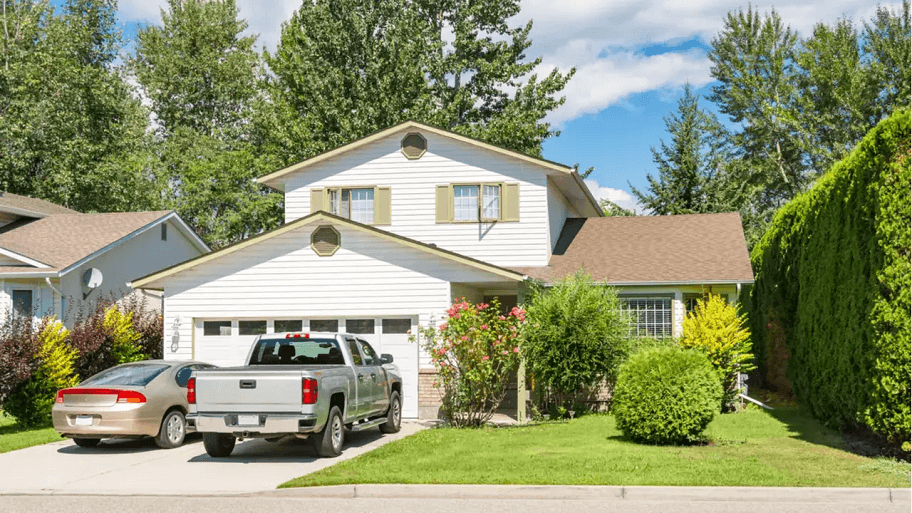

Mortgages provide financial solutions for diverse aspirations, from purchasing a dream home to refinancing an existing mortgage. CreditYelp is dedicated to providing expert assistance, helping you smoothly navigate the mortgage world. Furthermore, you can also get the know-how to secure the ideal mortgage that caters to your financial objectives.

By Louis Baker

By Louis Baker

By Louis Baker

By Louis Baker

with a Credit Card and Is It Worth

By Louis Baker

By Louis Baker

Explore the essential basics of mortgages and open the door to your financial success!

A mortgage is a loan from a financial institution or lender used to purchase a property. The property serves as collateral, ensuring the lender can recoup losses if you default on the loan. Mortgages have repayment terms typically ranging from 15 to 30 years.

Common mortgage types include fixed-rate, adjustable-rate, interest-only, and government-backed loans. Each type has unique features and benefits, such as consistent interest rates or lower initial payments.

Mortgage interest rates are determined by factors like credit score, loan term, loan-to-value ratio, and market conditions. Lower rates usually result from better credit scores, lower loan-to-value ratios, and shorter loan terms.

Down payment requirements vary depending on the loan type and lender. Conventional loans typically require 5-20% down, while government-backed loans like FHA, VA, or USDA loans may have lower or no down payment requirements.

Pre-approval involves submitting a mortgage application to a lender, who assesses your financial situation and creditworthiness. If approved, the lender provides a conditional loan offer, indicating the loan amount, interest rate, and terms you may qualify for.

To improve your chances of getting a mortgage, maintain a good credit score, reduce your debt-to-income ratio, save for a larger down payment, and demonstrate stable employment and income. Comparing multiple lenders and loan options can also increase your chances of finding a suitable mortgage.

The Latest

Louis Baker

Louis Baker